EQUITY SAVINGS : A SMART ALTERNATIVE TO DEBT MUTUAL FUND?

- Sun Sep 29 18:30:00 UTC 2024

- In Personal Finance by Malhar Majumder

“Do you know why you can drive your car fast? It’s because it has brakes” – Simon Sinek

Mr. Sumanta has been actively investing in equity mutual funds. The appreciation in his portfolio started post-Covid. He has made decent returns but is now facing a barrage of disturbing (conflicting) information about high valuations, geo-political risks, and probable election outcomes, all of which he presumes may hurt his tidy profits sitting in his current equity mutual funds portfolio. Further, he would like to understand how he will invest the future monthly surplus during the next three to five years to achieve his desired financial goals. He wants to protect his gains but wishes to maintain long-term future gains from the markets. This is likely because of various positive factors like the demographic dividend, the China + 1 strategy, and projected higher GDP growth.

A (comparatively) safer option could be investing in a Debt Fund. He is reading a lot about these categories of funds in newspaper articles. They otherwise look friendlier than equity funds in terms of volatility. Still, their attractiveness is marred by a change in tax laws during the Budget 2023. Any capital gains made in debt funds, invested after 1st April 2023, are added to total income directly and taxed at the highest ceiling rate of the investor. Sumanta's current income is taxed in the thirty percent tax bracket. Therefore, he is not happy with the decision at all. He is looking for something that will grow like Equity, bring stability like Debt, and benefit from lower taxation. It is like that fast car with an efficient braking system and best-in-class fuel efficiency.

There are fifty-two weeks in a year. SEBI, the capital market regulator, mandated fifty-one categories of Mutual Funds to keep us busy most of these weeks. Now, one these categories happen to be the "Equity Savings category," which was floated by SEBI in the year 2017, as part of its mutual funds' re-categorization exercise. These Equity Savings funds are open-ended, hybrid category funds that invest in stocks, bonds, and derivatives.

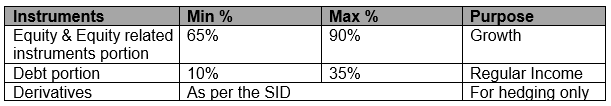

Let us look a dig deeper to find out how these funds work internally and why they may offer stable returns with moderate levels of volatility. Equity Savings funds must invest at least 65% of their corpus in equity or equity-related instruments. They must also invest at least 10% of their funds in Debt. They can further invest in derivatives only to hedge their equity investments as mandated in the approved Scheme Information Document (SID).

Readers are generally aware of how a portfolio's Equity and Debt portion of investments works. The unique proposition of this 'Equity Savings fund', which has both Equity and Debt, is the Derivatives portion of the portfolio. The fund manager can effectively use it as the braking system of her overall portfolio. She can invest in the stocks where she has conviction, but in case of any reversals to those stock positions, the derivative exposure will create a safety net and will not allow it to fall below a certain level. As every strategy has its pitfalls, using derivatives in portfolios increases the overall fund management cost. The higher cost offsets the gains if the equity market continues its northward journey. Therefore, this 'Equity Saving fund' is an option for investors who wish to optimize their risk-taking ability and are also looking for an alternative to their debt mutual fund portfolio. Equity Savings Mutual Funds offer a moderate option for first-time investors who would like to experience the market but are not very comfortable with the negative flow of information, the macro environment, and incessant volatility. The holy grail of minimum tenure of stickiness in any investments with equity exposure is three years, and no deviation from this rule applies when investing in an equity savings fund.

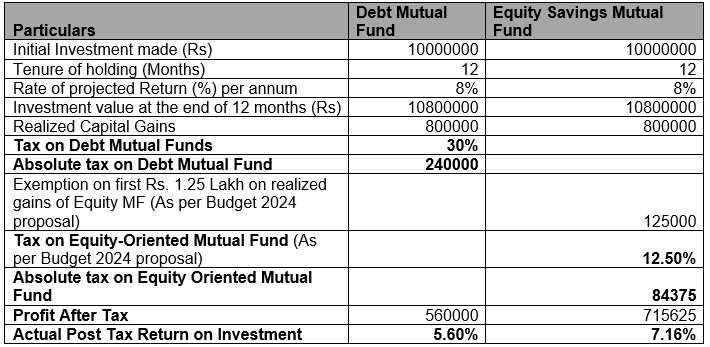

Taxation invariably comes as a necessary rejoinder when we discuss investment options. Every rupee we can save through effective tax planning finally adds to the overall corpus and helps achieve financial goals faster. Debt Funds lost part of their luster when Capital Gains indexation benefits were removed in Budget 2023. The 'Equity Savings fund', which we argued, offers a combination of stable returns with lesser volatility, offers Equity Capital Gains taxation. Any investor who holds these funds for more than twelve months and realizes capital gains by selling them off will only provide a 12.5% percent tax on the realized capital gains, as per the proposed recommendations of Budget 2024. This is an improvement on the 30% tax level and gives a window of saving around 17.5% extra tax impact on one's profit compared to a pure Debt fund.

Let us showcase the tax calculation on a 1 Crore investment in a Debt Mutual Fund versus an Equity Savings Mutual fund for more than 12 months, and after considering both, offer a return of around 8% per annum on the Investment. The Equity Savings fund demonstrates its tax efficiency levels vis-à-vis its Debt counterparts.

Of course, in the end, we can reveal our thoughts, and give options, but the final choice to be or not to be in it rests with you.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts